Remote working has become increasingly popular. Back in 2020, employers had to find ways around Covid restrictions, with many businesses taking their operations online. The trend is still holding firm, with many employees preferring the flexibility of remote working.

NoHQ is packed full of useful guides and information about all things remote working. It’s worth checking out if you’re planning on taking the plunge into implementing remote working.

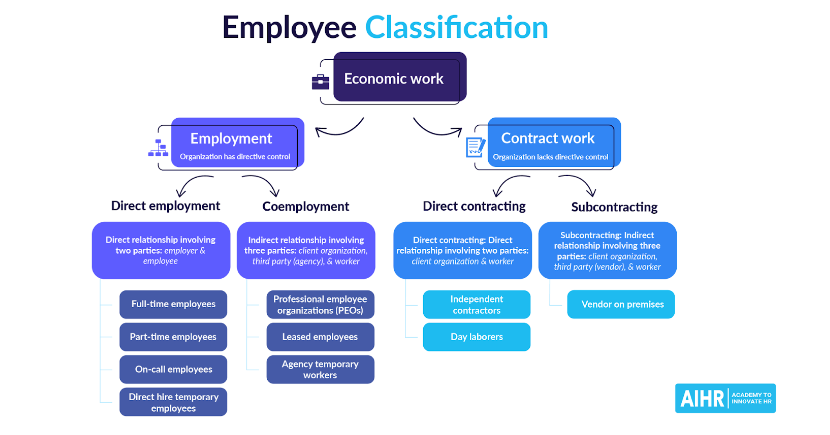

One thing to consider when managing a remote team is employee classifications. Today, we’re going to talk about employee categories and classification to help you meet your legal requirements.

What is Remote Employee Classification?

Remote employment classifications determine the benefits plan a remote employee can receive in accordance with federal and state laws. While federal law decides whether an employee is exempt or nonexempt, it is up to each employer to define employee categories as full-time, part-time, or temporary.

Employers should clearly set out definitions of employment classifications in their employee classification policy.

What Are the Different Types & Examples of Remote Employee Classification?

Now, let’s take a look at the different types of remote employee classifications:

Full-time Employee Remote Workers

A full-time remote employee completes all of their working hours from home. They are employee classification examples of fully-remote workers.

Employers set their organization’s full-time hours. However, in accordance with federal law, non-exempt employees are eligible for overtime payments if they work more than 40 hours in a week. For this reason, organizations commonly define ‘full-time’ as between 35 and 40 hours per week.

Remote Independent Contractor

Next in our employee classification examples is a remote independent contractor. This isn’t an employee type as such. Rather, it is someone who works for a company on an independent basis. Therefore, they can set their own rates of pay and working hours.

An organization may hire a remote contractor to complete one-off projects, such as developing a website.

Diversified Remote Workers

Sometimes referred to as hybrid-workers, diversified remote workers are employee classification examples who split their working hours between the office and home.

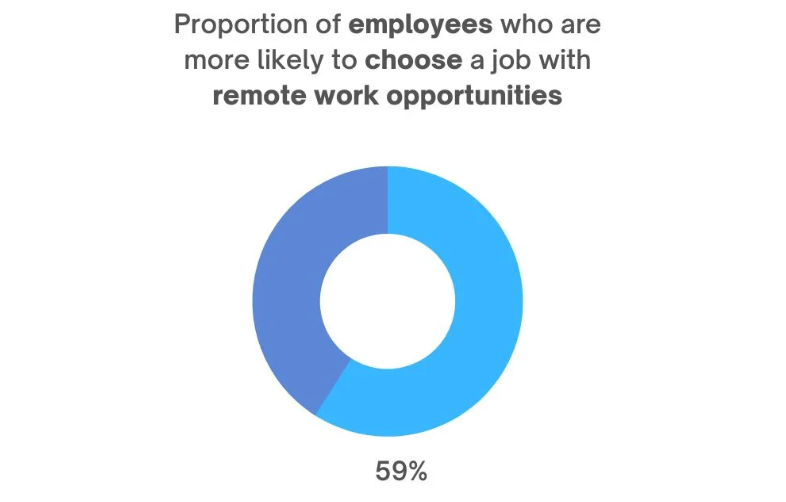

According to Zippia, 74% of U.S businesses either have a hybrid working model or plan to implement one. And, 59% of employees would favor an employer who facilitates hybrid-working.

NoHQ has a comprehensive guide to hybrid-working. It covers challenges you might encounter managing this employee type, as well as how to maintain your company’s culture.

Exempt VS Non-exempt Employment - What’s the Difference?

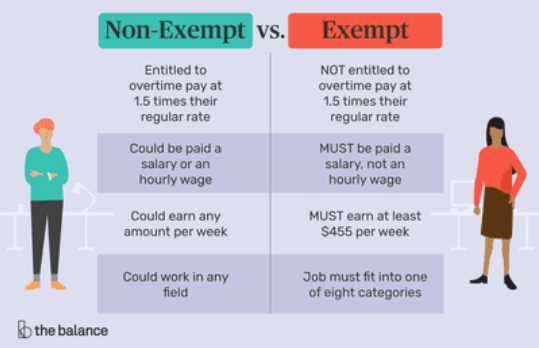

Exempt and non-exempt are other employee classification examples. They are employee categories with some key differences. Typically, an exempt employee is paid a salary. This means they are not entitled to overtime pay if they work above 40 hours pexr week. Conversely, a non-exempt employee will be paid an hourly wage.

To be classified as exempt, there are three criteria they must meet:

- Salary - this must be a fixed salary that is at least twice the state minimum wage.

- Duties - employees must spend at least half their working time completing white collar tasks such as professional or executive duties.

- Judgement - employees must regularly be allowed to use their own judgement about business decisions. They may also be responsible for at least two other employees.

Why is Employee Classification Important for Your Remote Team?

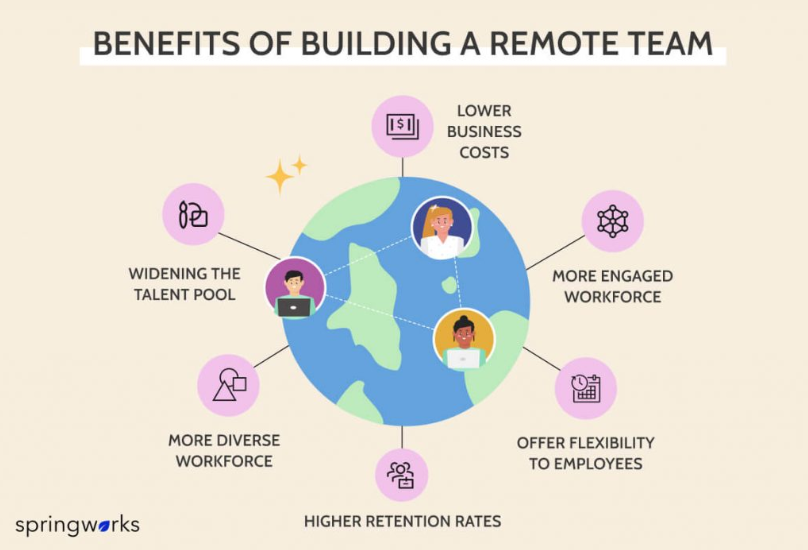

Correct employee classifications are important for ensuring that workers receive what they are entitled to in accordance with federal and state laws. This includes social security benefits and healthcare.

Equally, if an employer places their workers into the wrong employee categories, they might be dodging their responsibilities to pay other expenses like workers' compensation insurance.

Here are four specific reasons why it’s important to classify employees correctly:

It Helps You Give the Right Rate for Each Employee

Class codes are used as a basis for insurance companies to establish the risk levels of jobs. A remote worker will have a different class code than a warehouse worker, for example. Compensation rates differ between codes and states.

Correct employee classifications help ensure you give each employee the right rate.

It Helps Companies Abide by Labor Laws

Correct employee classifications help ensure companies abide by local, state, and federal laws. By law, employees are entitled to certain working rights such as minimum wage, breaks, and worker compensation. Having employees also comes with additional tax laws to abide by. For example, withholding Medicare taxes and social security taxes.

Lessen the Risk of Wrong Benefits and Other Costs

Misclassifying your workers increases the risk of workers receiving the wrong compensation and benefits. Part-time and full-time employees, for example, have different entitlements. And, an independent contractor will have fewer compensation rights than an employee.

It Helps You Build a Good Relationship With Your Diversified Team

Getting your employee classifications right will help you avoid lapses in productivity. Your diversified team can get on with their tasks feeling secure in their classification status. This will help build good relationships with your diversified team with minimal disruptions.

Consider your employees’ needs and establish an employee classification policy that suits everybody.

Five Essential Steps to Avoid Employee Misclassification

Employee misclassification is an offense. According to a report by NELP, between 10% and 30% of employers misclassify their employees. This leads to billions lost in government and state revenue each year.

Head over to NoHQ to learn the ins and outs of managing remote employees. This fantastic educational platform is your go-to place for tools and resources to enable remote working. And, importantly, keeping within the law.

Here, we’ll will go through five steps you can take to avoid employee misclassification:

Step 1: Know the Differences Between Employees and Independent Contractors

Although you might pay an independent contractor and employee a similar amount for the same work, there are different legal requirements for the employee categories. Independent contractors, for example, are not subject to employment and labor laws.

Here are some key differences to help you sort your employees from your independent contractors:

- An independent contractor controls their work and how they carry out their tasks.

- An employee enjoys benefits like healthcare, insurance, and a pension plan.

- Independent contractors are hired to take on specific projects which are detailed in a contract.

- Contractors will send an invoice when their payment is due. They are not on the company’s payroll.

Step 2: Establish a Process for Assessing Classification Status

Ensure consistency throughout your company by establishing a process for assessing employee categories. Setting out a clear employee classification policy will give you the confidence to know you’re not breaking any laws.

You must follow this process every time you bring someone new into the mix. Additionally, you need to assess each individual’s role regularly to make sure they haven’t altered.

Document your process thoroughly so that you have plenty of proof if your company is ever audited.

Step 3: Build a Program for Independent Contractor Engagement

Engaging with independent contractors comes with compliance risks. Your program should include procedures that you will follow when working with contractors. Having a program like this in place will help you manage compliance risks. Plus, it can help boost the efficiency of your workforce.

Step 4: Ensure Employment Contracts are Professionally Drafted

Employment contracts should be thorough. They must clearly define what the worker will do, their payment structure, and any time scales relevant to the position.

Although a contract should specify the employee type, this statement alone doesn’t necessarily place them in those employee categories. This is determined by other factors, such as whether they are on the payroll.

Step 5: Engage the Services of a Trusted Business Solutions Provider

The easiest way to make sure your company abides by employee classifications laws is to hire a professional to take on this task. Entrust your employee classification policy with an expert for peace of mind.

Wrapping Up

Remote employee classifications might not be the most exciting topic in the world. However, it is one of the most vital components of a good working relationship. Employers are bound by law to sort their workers into correct employee categories.

Your first task is to set out clear definitions of each type of worker you engage with. You must then take the steps outlined above to avoid employee misclassification.

And, if you need some extra help, be sure to check out NoHQ’s abundance of remote working resources. It was created for businesses like yours to get the most out of their remote workers.